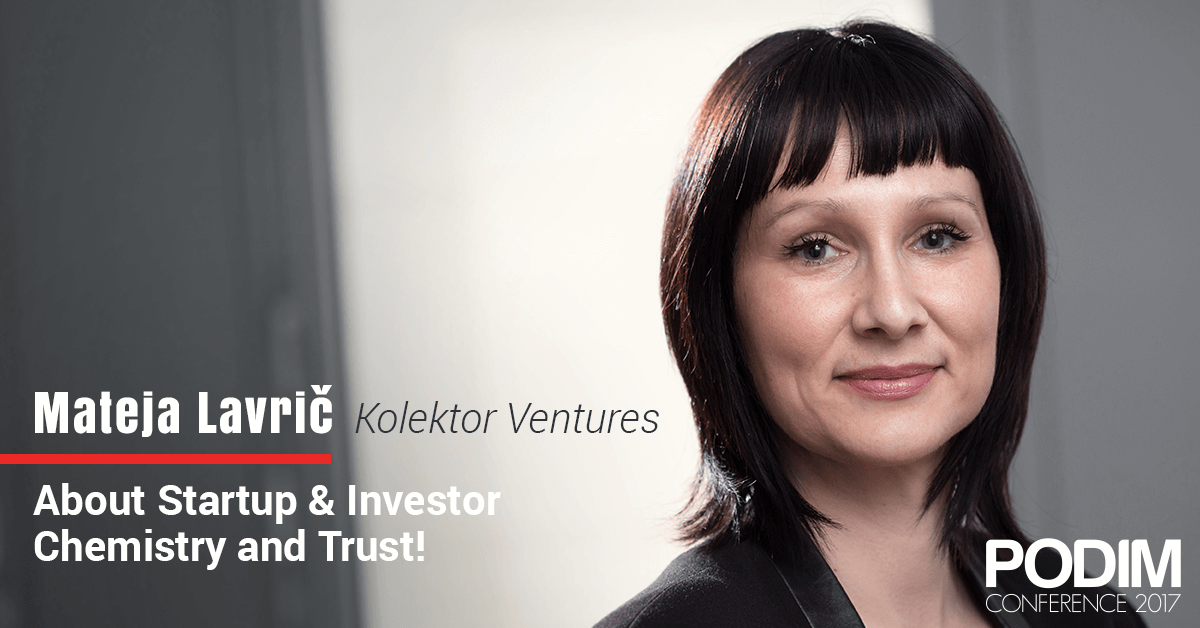

Mateja Lavrič, Kolektor Ventures: There needs to be some chemistry between the investor and the startup; a feeling you can work together and trust each other

More than 140 conducted interviews with startups from Slovenia, Italy, Bosnia and Herzegovina, Austria, Germany, Great Britain and the US, first three successfully concluded investments and two new ones on the way are the impressive results of the corporate fund Kolektor Ventures in its first nine months of operations. We talked to the managing director of the fund, Mateja Lavrič, about the fund’s experience with the leap onto the national and regional startup scene and what is the thing that ends up swaying the investor scale. Kolektor is also this year’s PODIM Challenge partner, so information from this interview can be helpful if you’re a startup working in Industry 4.0 or industrial IoT and solutions for smart factories, and you’re looking for an investor that brings a lot more than just money!

Kolektor Ventures fund was introduced last year at PODIM, and you’ve closed quite a few promising investments so far. What are your plans until the end of this year?

It’s true, the fund will celebrate its first anniversary this year, because we took advantage of the opportunity to present it at the biggest startup event in the region. We started intensive work a couple of months later, last August. Our first investment was given to a company with an app for vision and eye examinations, the second investment to a startup from the field of smart devices, and the third to a company working in virtual reality. We are currently concluding negotiations with two startups, one working in 3R, that is virtual, enriched and mixed reality, and the other working in predictive analytics. Otherwise we wish to close at least five to ten investments by the end of the year.

How did you handle searching for and establishing contact with startups?

Considering the experience of other similar funds, we judged that it makes most sense to focus on partners from startup ecosystems. So we started introducing ourselves to accelerators, incubators, technology parks, institutes, universities and other funds, namely everyone that has access to successful startups. We of course also introduced the fund’s operations to Kolektor employees, because they come in contact with companies that can be suitable for us from the aspect of matching. Most often, we got hints about good teams through our partnership network, and nearly a third of startups found us by themselves. They got the information about us from the media, on our website or from talking to other startups and ecosystem stakeholders. We got certain contacts “by order”, by doing goal-oriented searches in fields in which we wish to invest.

How would you summarize your experiences after nearly a year of combing through the startup ecosystem?

The experience is actually very positive, because this part of the region has a very developed startup scene, especially Slovenia. We have a couple of high-quality teams with incredible products. But we are noticing a big difference between teams that already have experience looking for investors abroad and those who are doing it for the first time. Companies from the first group know exactly how the negotiation process looks, what they can expect from the strategic investor and what their role in the company is. That is why investment talks are significantly easier, for both sides, and they are also concluded faster.

So the understanding is good, the scene developed … What about the teams that don’t have such experiences?

If we look at a typical Slovenian startup, without the experience of pitching and circling around funds abroad … Such a startup still has some reservation towards investors, because the received investment means they have to give up their complete control over business operations. The investor just wishes to protect their investment and do everything to make the company successful in the long run, so of course they wish to help company operations with all their resources and the business network at their disposal as well as, of course, mentorship, advice and experiences. All this means that the startup doesn’t need to “invent hot water” and learn on their own mistakes and blunders.

So could you say that the startups completely understand the role of a strategic investor?

Most companies we’re in contact with aren’t looking only for a financial investment but rather for an investor that can offer an entire range of services – from comprehensive support in product development and polishing the business model to final market penetration and everything that the startup company needs in between. It sometimes happens that the startup company developing a product for the industry sees us mostly as a customer and not as an investor. They wish to sell their solution to us, but they don’t want to let an investor into the ownership structure. A strong corporate brand can also frighten people. But our purpose isn’t to acquire the company. We invest into fields that we don’t know as well as the startup developing the product, but we can help them arrive to their final goal with our business and partnership network as well as all industrialization experience, so that is a win-win result for both sides.

For a good understanding it would probably help if startups had the option of walking in the shoes of an industrial giant …

Many startups believe that they have a winning product with which they will easily penetrate the market, but they don’t realize that facing the competition takes a lot of energy, innovative business approaches and, in the industrial field, a lot of patience as well. Here, the cycles are a lot longer, returns smaller, but the lifetime of a certain solution can be significantly longer. Surviving in the industry today definitely isn’t simple.

What are your current experiences about the desired amount of investment and company valuation?

Every startup values itself highly, which is understandable, because every person highly values their work and achievements. In Slovenia, we encountered the usual practice that the valuation of a company looking for seed company starts at two million euros and higher. Usually this value lowers significantly when the company offers the product on the market and faces market valuation. Unfortunately, or maybe luckily, there is no magic formula for valuating startup companies in early stages. Because we can’t determine the company’s value through accounting, like in traditional entrepreneurship, there is the law of supply and demand – the investor and startup meet at a certain value where both are still satisfied.

What excited you most about the startup teams you’ve come into contact with so far?

We are certainly most excited about teams with energy, enthusiasm and an entrepreneurial mindset. If the team is good, it will be able to develop any product, so our experience also confirms that people are the most important part of the investing equation. This is followed by the potential market, business model and product.

What are you looking for in people and teams ... The values, ways of thinking ... And how do you integrate them into the corporate culture?

We are looking for similar values shared by Kolektor and the teams with which we wish to strategically connect – innovativeness, team spirit, market focus, responsibility, fairness and a fighting spirit. But only values aren’t enough and it is also difficult to realistically assess a person’s values after only a couple of meetings. So there needs to be a certain chemistry between the investor and the company, giving you the feeling that you can work together and trust each other. And as far as integration is concerned, we sometimes notice the fear of a young company that the multinational will absorb it. Our intention isn’t to integrate startups into the corporate culture, I’d sooner say the opposite, because we wish to keep its original startup attitude.

How long does it take from the first talks to a closed investment?

Experiences are very different. These negotiations are a lot faster with companies that we meet beforehand in a pilot project and with startups that already have experience finding an investment, because both sides more clearly know what they can expect. On average, the entire process from the first talks to signing the investment contract takes from three to six months.

How do you participate in the business operations of startups into which you invest?

We talk to the first startup we invested in at least once a month, mostly so that we stay up-to-date with the development, marketing and user reactions to the application. A member of the Kolektor Ventures team is also the team’s mentor, and they have facilities in one of our companies in Ljubljana. We don’t wish to lead the startups and we also have no intention of acquiring them. We are trying to help them with a bunch of services that Kolektor has at its disposal, including fiscal and legal consultations, accounting … We can also give them access to all the companies that are part of the group, which is the ideal polygon for testing pilots, prototypes and other ideas.

Which are the most plausible scenarios regarding the exit or the market capitalization?

At the very beginning, we decided that Kolektor is entering startups as a strategic partner. That means we don’t have set time limits for exiting the ownership structure. We wish to grow with the companies and create new content in the field of Industry 4.0 and industrial IoT, new materials and production solutions to use in smart factories … in short, everywhere where we can create new success stories together.

Do you prefer it if a team contacts you directly or if somebody does a warm introduction with a recommendation?

In principle we don’t have preferred approaches. But we definitely always check what experiences others had with the team. The ecosystem is very connected and information, about teams as well as investors, quickly travels from mouth to mouth.

- - -

Get in touch with Kolektor Ventures team

If you wish to meet the team that stands behind Kolektor startup activities and meet it at this year’s PODIM Conference, get in contact with Mateja Lavrič ([email protected]) and Andrej Čušin ([email protected]) or write to them via the contact form on their website.

- - -

More information about how to collaborate with Kolektor:

- How can you give meaning to new technologies for smart factories of the future?

- Kolektor is investing into startups with disruptive solutions in the field of smart factories and industry 4.0!

- What kind of startups are PODIM Challenge 'corpo' partners? Also, why and how to cooperate with them?

- - -

Photo: Mateja Lavrič, managing director Kolektor Ventures

- - -

Author: Stanislava Vabšek, Start:up Slovenia Initiative